Key Insights

- Analysts highlight key support levels, with a breakdown risking further downside in the coming weeks.

- Whale accumulation has increased, though market prices have yet to react to recent buying activity.

Bitcoin price has faced massive decline in the recent trading sessions and dropped below the $90k mark. Amidst the significant volatility, Bitcoin price defended the $80k support zone and was poised for a recovery.

At press time, Bitcoin price was trading at $81,602 with an intraday decline of over 1.22%. Its market cap stood at $1.62 Trillion and has a total supply of 19.83 Million.

Strategic BTC Reserve Move: What’s the Impact?

The news of Bitcoin reserve creation triggered substantial attention from financial market experts along with investors.

This initiative sought to establish United States dominance in digital asset strategy through deployment of cryptocurrencies for strengthening national wealth.

The strategic proposal combined Bitcoin along with digital assets to create an economic stability framework which fostered innovation.

Investors remained unclear regarding the future of the reserve because no clear regulations were provided when the announcement was made.

Investors in the market anticipated substantial Bitcoin purchases from the U.S. government to directly involve the national currency in digital assets.

The release of seized assets information in the plan caused investors to reduce their positive outlook. The change of approach led Bitcoin prices to decrease because investors viewed it as a sign of reduced government participation.

Whale and Shark Activity Suggests Signals Accumulation

On-chain data from Santiment shows whale movement patterns during the previous six months to present analysis.

Minor selling activities caused market value to decrease throughout this period.

From March 3 until March 11 the leading Bitcoin wallets invested approximately 5000 BTC in the market.

The purchases made by whales and sharks in markets do not trigger abrupt price shifts.

According to Santiment the market response for March will be positive since big investors persistently buy Bitcoin.

During this crucial period Bitcoin traders use their transaction patterns to decide on fundamental support and resistance boundaries which direct market movement.

Bitcoin Price Prediction: Key Levels to Watch

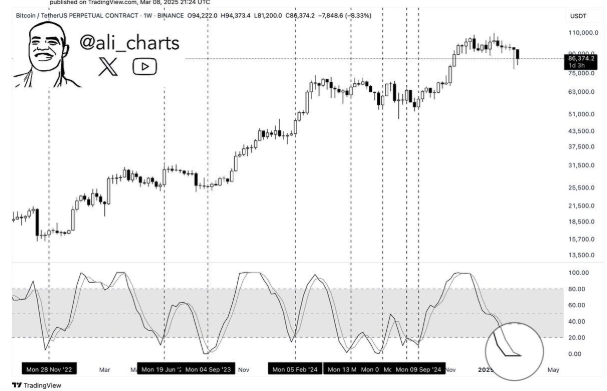

A recent post on X by Ali Charts revealed that, BTC price was hovering close to its critical trendline support zone of $78000.

In case of defending the zone, the uptrend remains intact and further bullish trend would continue ahead.

If it fails to defend the trendline support, a major decline could be seen next.

Historical data shows that Bitcoin recovers after price extends too low, and when Stochastic RSI cross events take place in negative territory.

The markets have observed crossover patterns before major price hikes numerous times, and a new crossover is forming.

In the past 24 hours, the Open Interest (OI) shed over 0.98% to $46.35 Billion, witnessing a long unwinding move in the past 24 hours.

Around $69.8 Million of long positions have been liquidated compared to $47 Million in shorts in the past 24 hours.

The immediate support zones were $78k and $75k, whereas the upside hurdles were $84k and $88k.

Disclaimer

In this article, the views and opinions stated by the author or any people named are for informational purposes only, and they don’t establish the investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.